Swipez is now a Briq company

Swipez is now part of BRIQ DATA ANALYTICS INDIA PRIVATE LIMITED! Read the press release announcing the acquisition.

Learn more

Swipez is now part of BRIQ DATA ANALYTICS INDIA PRIVATE LIMITED! Read the press release announcing the acquisition.

Need to check your Input Tax Credit (ITC) accurately? Need to identify irregularities in your expense data and your vendors' GST filings. Identify and reconcile differences to save time & ensure accuracy.

Dashboard

Need to check your Input Tax Credit (ITC) accurately? Need to identify irregularities in your expense data and your vendors' GST filings. Identify and reconcile differences to save time & ensure accuracy.

DashboardDefine the date and time limits for which you want to compare your expenses and your vendors’ GST invoices. Swipez will collect & curate your vendor’s GST fillings from the GST portal as per your defined timeframe. Your expense data will be compared with the corresponding GST portal data to ensure consistency.

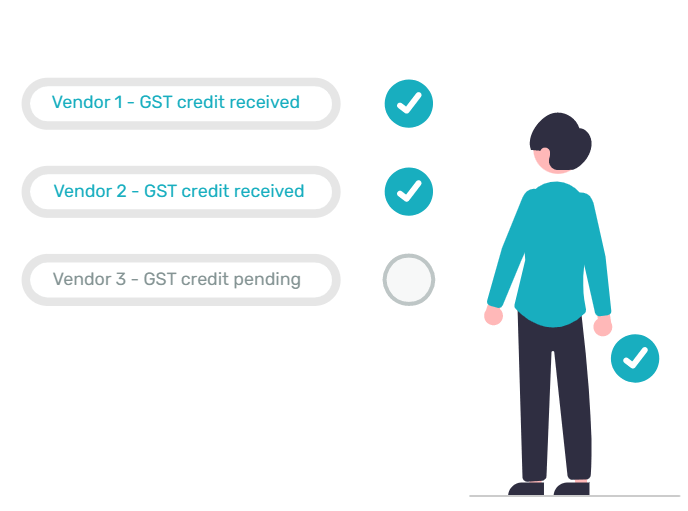

The different details of the GST reconciliation data will be automatically compared to help identify any differences. Any differences between your expense data and GST portal data will be highlighted.

Resolve differences in GST reconciliation data to ensure error-free input tax credit. Reduce time and labor spent on curating data, coordinating with vendors, and settling differences. Notify vendors about gaps in their GST filing via email directly from your online GST reconciliation software.

Compare your expense data with the invoices uploaded to the GST Government Portal by your vendors. Match expense data with those filed on the GST portal by the vendor.

Compare your expense data with the invoices uploaded to the GST Government Portal by your vendors. Match expense data with those filed on the GST portal by the vendor.

Define the time frame for your GST reconciliation as per your requirements. Compare and reconcile GST records for a month, a quarter, or any custom period as suits your needs. Run advanced filters to slice-n-dice your GST reconciliation reports to get all the GSTR information for your chosen timeframe.

Define the time frame for your GST reconciliation as per your requirements. Compare and reconcile GST records for a month, a quarter, or any custom period as suits your needs. Run advanced filters to slice-n-dice your GST reconciliation reports to get all the GSTR information for your chosen timeframe.

Identify variations between your expense data and GST data as filed by your vendors. Ascertain that all invoices for the time have been recorded and filed.

Identify variations between your expense data and GST data as filed by your vendors. Ascertain that all invoices for the time have been recorded and filed. Differences in GST reconciliation reports may include-

Get all-inclusive GST reconciliation reports for your pre-defined time frame. The number of invoices filed by your vendors, any differences in invoice numbers, differences in data both in your expense data & your vendor’s filings, along with differences in taxable amounts, and more. With an efficient & simple side-by-side tabular view of the detailed summary of the different reports, you can easily prioritize your reconciliation as per your requirements.

Get all-inclusive GST reconciliation reports for your pre-defined time frame. The number of invoices filed by your vendors, any differences in invoice numbers, differences in data both in your expense data & your vendor’s filings, along with differences in taxable amounts, and more. With an efficient & simple side-by-side tabular view of the detailed summary of the different reports, you can easily prioritize your reconciliation as per your requirements.

Notify your vendors when a GST reconciliation process shows mis-match for their GST invoices. Request corrections and reconciliation directly via email with a copy of the report attached directly from your GST reconciliation dashboard.

Notify your vendors when a GST reconciliation process shows mis-match for their GST invoices. Request corrections and reconciliation directly via email with a copy of the report attached directly from your GST reconciliation dashboard.

Reconcile small differences like invoice number, or missing information in your expense data in just a few clicks. Update your expense data directly from your GST reconciliation dashboard. Make adjustments & auto-update your expense ledger.

Reconcile small differences like invoice number, or missing information in your expense data in just a few clicks. Update your expense data directly from your GST reconciliation dashboard. Make adjustments & auto-update your expense ledger.

70% faster GST reconciliation for your Input Tax Credit. Run online GST reconciliation on 60K invoices in less than 6 seconds.

70% faster GST reconciliation for your Input Tax Credit. Run online GST reconciliation on 60K invoices in less than 6 seconds.

Ensure a 100 % accurate Input Tax Credit (ITC) filing for your business with an online GST reconciliation software designed and trusted by 2000+ tax experts. Avoid errors when claiming Input Tax Credit (ITC) returns, notices, audits, and loss of refunds.

Ensure a 100 % accurate Input Tax Credit (ITC) filing for your business with an online GST reconciliation software designed and trusted by 2000+ tax experts. Avoid errors when claiming Input Tax Credit (ITC) returns, notices, audits, and loss of refunds.

No more pen-and-paper double checking of expense records. No more to-and-fro emails/messages/phone calls with vendors for verification & GST filing reports. Run GST reconciliation in just a few clicks and notify vendors about differences directly with a copy of the report attached.

No more pen-and-paper double checking of expense records. No more to-and-fro emails/messages/phone calls with vendors for verification & GST filing reports. Run GST reconciliation in just a few clicks and notify vendors about differences directly with a copy of the report attached.

Run and manage GST reconciliations for multiple GSTNs. Manage expense data for your different GSTNs, vendor data, and more from a single dashboard.

Stay on top of your Input Tax Credit with easy reconciliation of your expense data and vendor’s GST filing data from the GST portal.

Run GST reconciliation in seconds and notify your vendors with just a few clicks. Comprehensive reports that help you identify and slice-n-dice differences faster.

You are in good company. Join 25,000+ happy businesses who are already using Swipez collections software

"Earlier GST filing was time consuming and expensive. I am now able to file my own monthly GST R1 and 3B within minutes. I am able to stay GST compliant and not worry about monthly GST penalties anymore."

Mahesh Patil

Founder, Siddhivinayak Travels House

"Using Swipez GST filing we are now able to service more clients with the same resources. We are now able to automate large aspects of the filing process."

Amit Chordia

Co-founder, Chordia Sarda & Associates

Looking for more info? Here are some things we're commonly asked